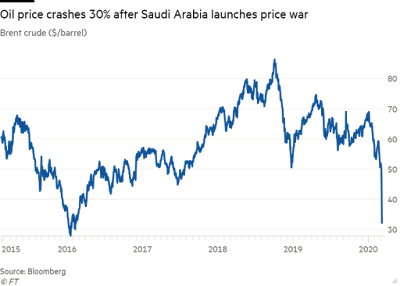

It's April 27th 2020 and an

unprecedented time. The oil markets have

collapsed. The price of oil went

negative for the first time ever. It was

something most people thought was a mistake when looking at the charts. I

seriously couldn’t believe my eyes when the line dropped below zero and the

effects it will have on our economy will be seen for a long time. Many people are glad to see gas prices drop

locally, but the impact may be worse in the long run for the average citizen. But was this the reason that the stock markets

made a rally today? Was that a needed

outlier that was part of the incline in the US stock market?

Most likely the 30% decline in oil did not cause

stock markets to rise. Instead finally the Federal Government and many local

State Governments are talking about reopening the local economy’s and

markets. This is bringing hope and

confidence to the investors.

Across the pond so to speak the markets are

possibly going to be opening up as well. France, Italy and even New Zealand are

starting to loosen restrictions and bring back their own economy in a small

way. Every little bit helps and if they

are able to stay safe and contain the Covid-19 pandemic and increase their

economic output they are going to. In times like this the markets are

flocculating widely and traders are making lots of profit. Companies like

American FX Capital are trading at all time highs and gaining huge percentages

on their portfolios. Not everyone has

the foresight of a market research company though and we are riding the ups and

downs with a little less clarity.

It seems that the local talk from different

states governors about how to loosen the social distancing restrictions has

given some confidence to traders. Many

of the strictest states like Michigan, Virginia and New York are finally

discussing a solution to the problem and are working on getting the many small

businesses back to work. At this point

it seems like many of the states are simply waiting on another state to make

the first move. Everyone wants to track

the data of how effective the loosening measures are going to be and if they

will end up flooding the hospitals to past capacity. It is a game of chicken and the citizens'

lives are at stake. As per the normal we are only talking about the market as

we see it and not giving financial advice.

Please see your local broker, investment firm, or attorney for financial

advice.